News and Blog

Morning Thoughts – June 14

Crops - Spring wheat speculation is all the buzz right now so allow me to jump on the bandwagon and pretend I know what I’m talking about in regards to HRS. We know one of the first questions that can come up in years of poor conditions is abandonment of area. ...

Morning Thoughts – June 13

Crops - As I’ve alluded to a few times since Friday’s WASDE, the lack of revision to the old crop soybean export figure has me perplexed. I really don’t know how WASDE would explain it, but for the sake of argument I’ve tried to approach the question with a bias of...

Morning Thoughts – June 7

Crops - We’re just a few days away from the Crop Production & WASDE reports, and that will be our primary focus for the remainder of the week. This morning I want to briefly discuss prospects for winter wheat production. Unfortunately, we still don’t have much...

Morning Thoughts – June 5

Livestock - We just saw a very active week of cash cattle activity, and I guess that’s what a big rally in prices will do for you. The range for cash trade last week was probably 135-138 and 215-220, with 136 and 218 as averages. Basis did narrow slightly. Packer...

Morning Thoughts – June 2

Livestock Cash cattle absolutely screamed higher yesterday and took the futures board along with it. This is the problem I mentioned yesterday…you have a cash market that just doesn’t want to break 130 to the downside and a deliverable futures contract trading well...

Morning Thoughts – May 31

Financials - A friend brought to my attention the spec (non-commercial) positioning in the Euro yesterday, and I’ve attached a 10-year history below. It is catching some attention because as you can see the net long position in the Euro is near the highest it has...

Morning Thoughts – May 25

Crops - Yesterday’s session might have been one of the more boring I’ve seen in quite a while. For the time being, I don’t see any reason to expect this boring price action to change. We have June option expiration tomorrow. In tomorrow’s comments I’ll include...

Morning Thoughts – May 24

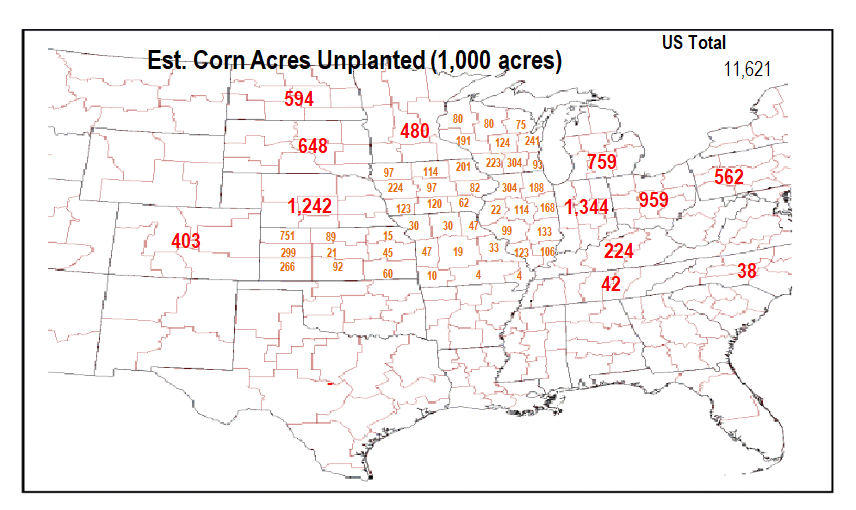

Crops - I mentioned yesterday I thought that some might be looking at early assumptions on Prevent Plant area and scaling back on those figures a bit. This seems reasonable considering the Northern Plains states typically lead the way in terms of PP area and those...

Morning Thoughts – May 23

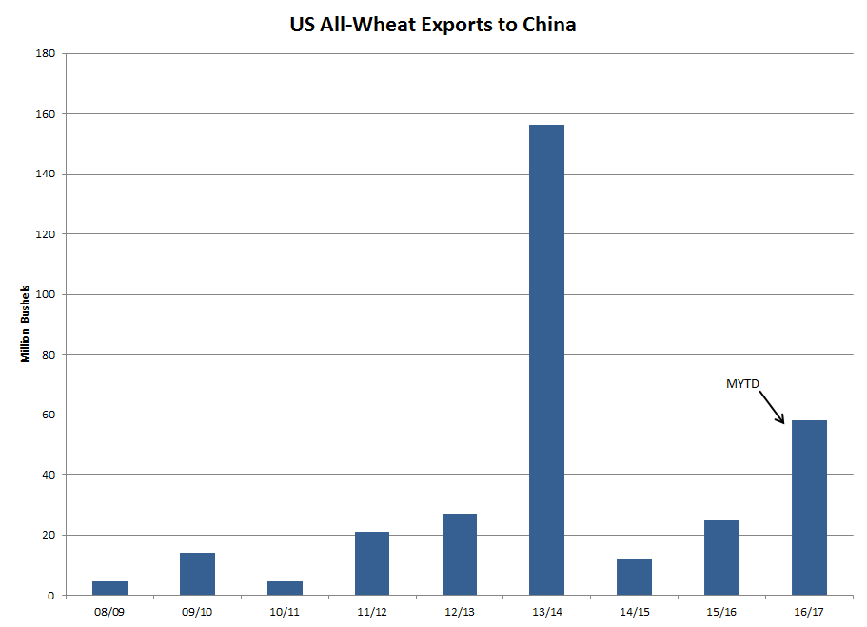

Grains - While reviewing yesterday’s export inspections data, one thing stood out to me. Over the past several weeks/months, we’ve continued to see ongoing and consistent wheat shipments to China. The chart below shows that MYTD export shipments are the strongest...

Morning Thoughts – May 19

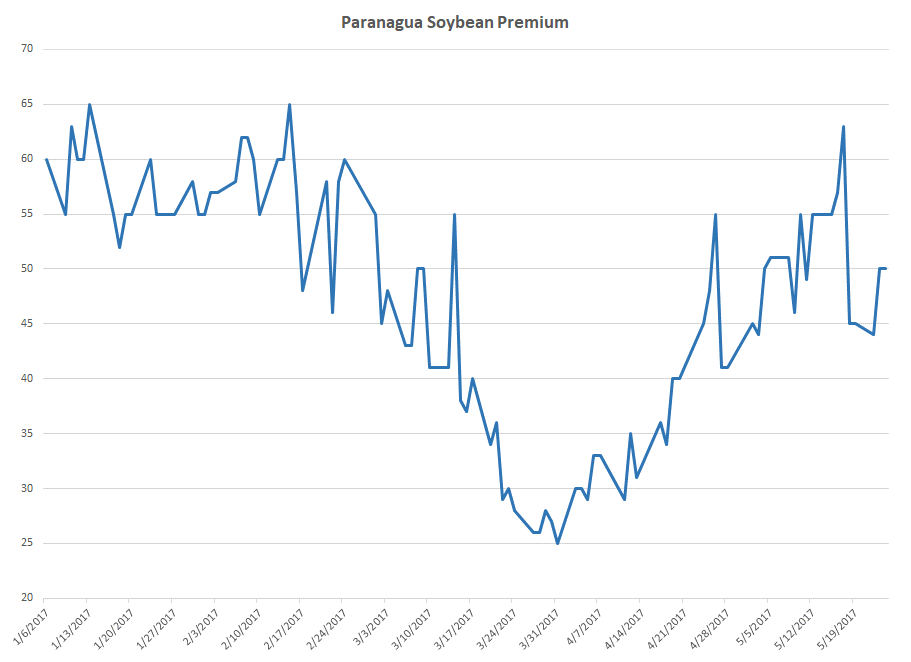

Grains - Not sure what to say after yesterday’s session. We knew the market would be under pressure following the news from Brazil but I’ll have to admit I didn’t expect a 30 cent decline yesterday. There was big pricing in Brazil yesterday, but estimates vary...

Disclaimer: none of the content provided on ctsfutures.com should be considered trading advice or recommendations. Opinions expressed here reflect those of the authors only and do not necessarily reflect those of Cunningham Trading Systems, LLC. Cunningham Trading Systems, LLC makes no guarantee as to the accuracy of the information published here.