Crops –

Crops –

No major remarks to make following yesterday’s USDA report deluge. For the most part, things fell pretty close inline with our expectations yesterday. I didn’t get everything right of course, but generally speaking things trended as expected.

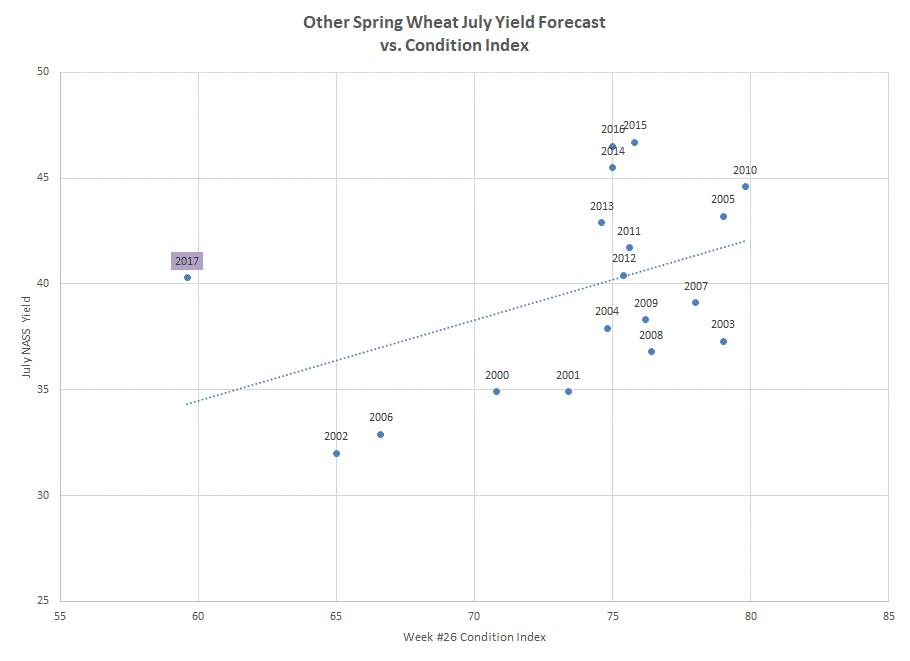

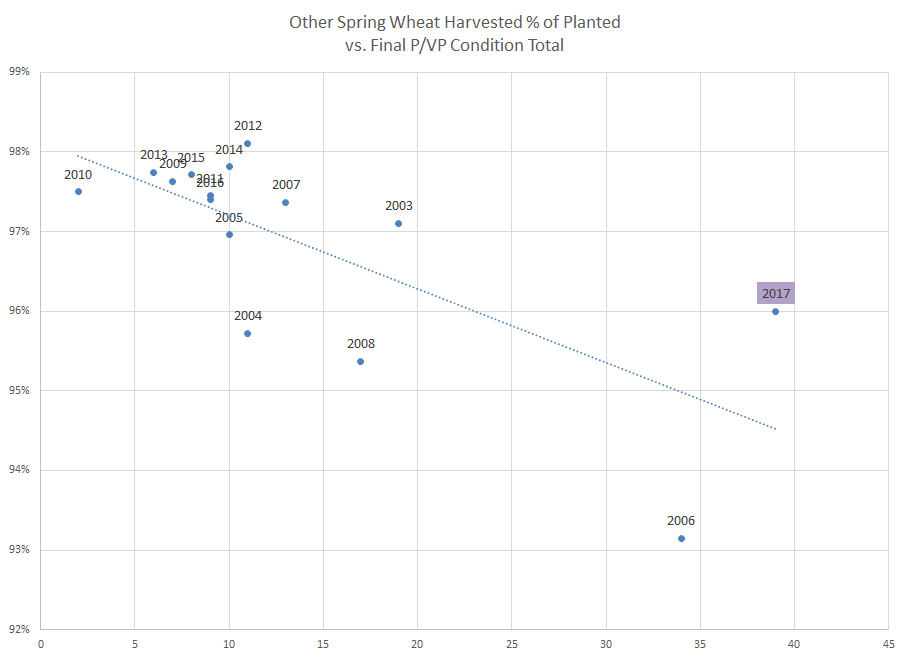

One thing I most certainly got wrong was the expectation for a smaller than expected spring wheat crop. I think NASS’s starting point is clearly too optimistic. I’ll present the following charts without much commentary as they pretty much speak for themselves….

So clearly I think NASS is optimistic on their projections for both yield and harvested area. We’ll see how this shapes up. Despite my pessimism towards crop prospects relative to NASS, I do view the MW board with some skepticism in the short term here as well. The speculative fervor has swelled in MW quickly, with lots of different news/financial articles published on the move recently. It is plain that this market is loaded up with bullishness. In the long run, I think that is probably the right call. In the short run, we know corrections in such an illiquid market can be highly unforgiving. Be careful.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.