Financials –

Financials –

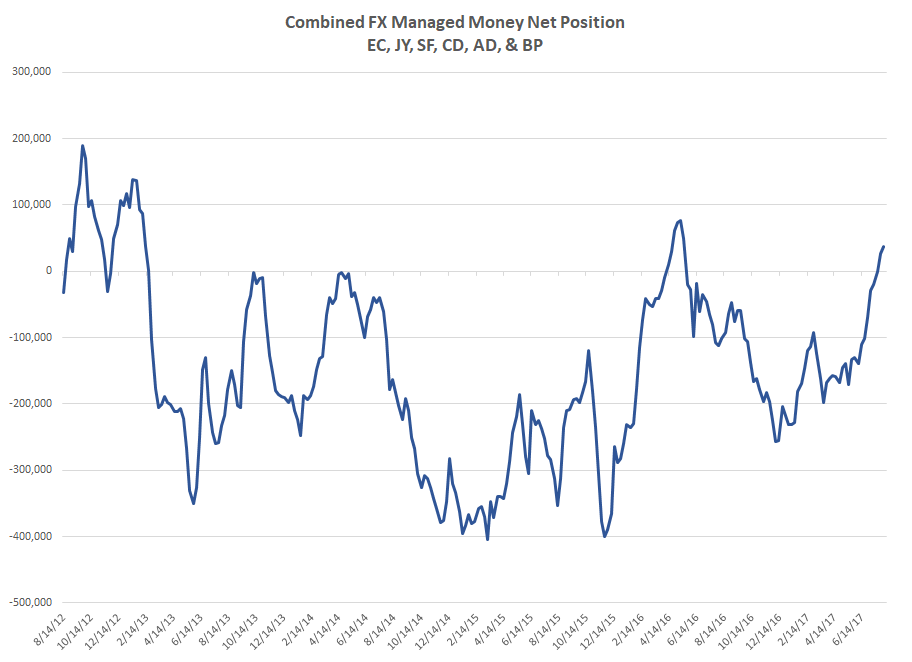

This morning price action just seems to be more of the same. The DX is weaker again and the euro is stronger. The only economic data out of Europe overnight appears to be German industrial production, which unexpectedly fell. The euro has shaken off that data to rally further. The dollar has quickly fallen out of favor among traders in the past month. The chart on the following page shows the combined managed money net position of the key FX futures at CME. This includes EC, JP, SF, CD, AD, and BP. The higher the figure moves, the more net short the market is leaning against the dollar. As you’ll see from the chart, the total positioning against the dollar is now near its largest level since early last year and is relatively “elevated” in general. Friday’s solid NFP bounce in the DX allowed it to back off from a major technical breakdown, but obviously the market in general is not optimistic towards the dollar’s chances here. With the debt ceiling issue looming ahead, I can’t say I’m optimistic either.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.