Energy –

Energy –

Fairly constructive inventory figures yesterday for crude oil, yet futures could not hold their gains. I suspect there is a wide assortment of reasons for the late day weakness, including but not limited to: 1) More EV articles yesterday 2) US crude oil production posted a solid increase from prior week 3) Talk of Trump administration opening additional drilling leases.

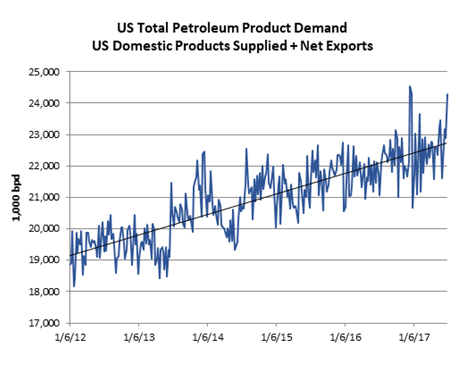

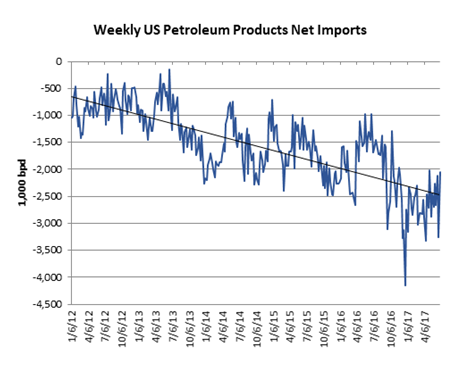

Despite the weak price action and seemingly endless negative newsflow, I do want to point out some constructive data from yesterday. Total demand for US petroleum products was exceptionally strong last week and as the chart shows below, it continues to trend higher. This trend is aided by growing US exports of petroleum products, although that didn’t play a major role in last week’s strong overall demand.

Despite a lot of focus on the coming EV surge (and I think that focus is indeed justified) it’s important to keep in mind that demand today is looking pretty robust. That said, markets are lower this morning on news that Saudi oil export upticked last month, perhaps calling into question the Saudi commitment to rebalancing supplies. Despite still producing less than their quota, the Saudis did increase production in June, raise exports, and lower prices to Asian markets. None of this is a good look for the oil market which is really struggling right now.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.