Crops –

Crops –

Yesterday’s session might have been one of the more boring I’ve seen in quite a while. For the time being, I don’t see any reason to expect this boring price action to change. We have June option expiration tomorrow. In tomorrow’s comments I’ll include charts showing where the key OI rests, but based on the recent price action you can probably already guess. SN 950-960, CN 370, and WN 430. Unless something whacky happens, I’d look for limit steady price action over the next two days as we chop around these strike levels. Take a load off, put your feet on the desk, grab a gluten-free slice of pizza and an ice cold beverage and relax. This stuff is probably going nowhere right now.

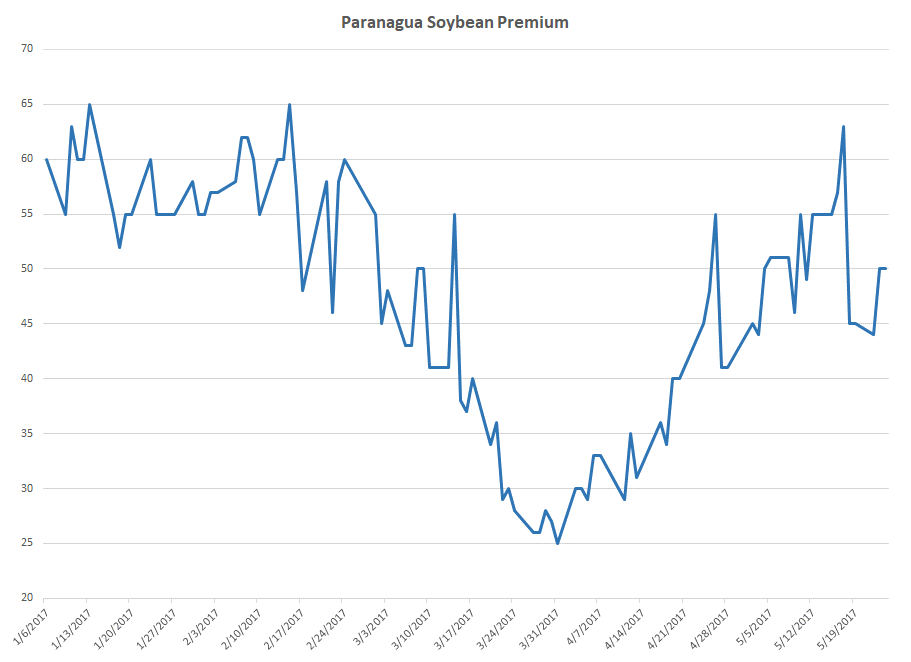

We do have export sales to get through today, but I’d put low odds on it showing us anything worth excitement. We did have one flash announcement last week, the 5/16 posting of 132k mt soybeans to unknown for 16/17. Overall I’d look for a continuation of recent trends. Soybean sales should continue to track ahead of the “necessary pace” and even today the US appears to be somewhat competitive for additional Jul/Aug business. Note that Brazilian soybean export premiums have firmed up slightly following the crash post-devaluation. While they have not recovered all of the prior strength, I still find this interesting and worth noting. I think newswires might have been a little carried away with their “Once in a decade” headlines on Brazilian farmer sales. Commercial sources imply to me that while movement was “solid” the Brazilian exporter is still sitting on a big short position and premiums could potential work their way back up. Certainly something we should be keeping our eyes on.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material