Grains –

Grains –

Last week saw the index rebalance come and go, and I thought it might be worth a quick look to see what OI did to see if it matched projections. Corn OI was up roughly 75k from Friday to Friday. This seems pretty inline with expectations heading into the index buying. Chicago wheat OI was up 25k from Friday to Friday, and this also seems pretty close to overall expectations. Soybeans saw OI increase about 35k, which is probably a bit larger than what we were looking for in terms of index buying but we also had other issues during the week including some surprises from the USDA and Argentine weather. Overall, I’d have to give those that compile these index rebalance guesses an A for their efforts this year.

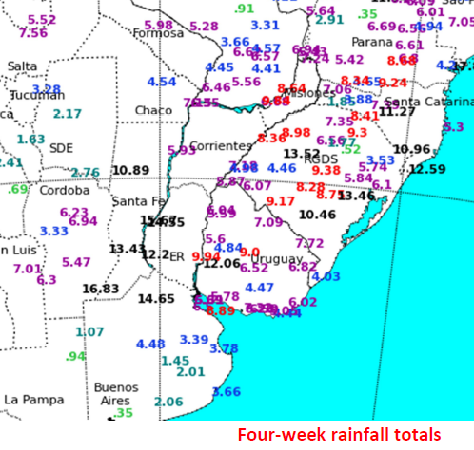

By this point you already know the key news driving price action in overnight trade. Argentine rainfall over the weekend was basically as-expected, meaning further heavy rains in areas that really didn’t need any more rain. I have attached here a map showing rainfall totals over the past four weeks through Argentina. You can see in some areas they’ve seen over a foot of rainfall during this period. In the attached maps of soybean and corn key production zones, you can see this is not an insignificant area in terms of production.

So now the market is debating and rethinking Argentine production potential. Previously, it seemed that most were of the opinion that whatever losses we’d see in Argentina could largely be made up in Brazil. I sense that sentiment is fading and the range of production guesses for Argentina is moving lower. WASDE left their production estimate at 57 mmt last week, and that is probably one of the highest estimates out there right now. If I had to guess I would say the market is trading something around a 52-54 mmt crop range, plus or minus a little (I see Cordonnier has dropped to 51 over the weekend). The good news is the forecast has a drier tone over the next 10 days (at least) which might allow for prices to calm down for a bit.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.