Livestock –

Livestock –

No major new information to pass along this morning. We’re still digesting the Chinese reopening news. While obviously this is good news for the US industry over the long term, there are still some hurdles to clear in the short term. One major sticking point I’m told is traceability of cattle and use of beta agonists. These factors will probably keep volume of trade pretty limited even when the market is “officially” reopened.

The beef market might finally be showing some signs of a top after a relatively soft performance on Friday. As mentioned last week, we need to keep an eye on the 50s probably for signs of its “last hoorah” before really having confidence beef has topped. Packer margins have improved, on paper, recently due to the strength in beef and the relatively softer cash trade we’ve seen. Interesting to note that last week’s kill was a bit smaller than expected. Considering the strength in beef and decent margins, one might expect they’d have pushed a bit harder than that.

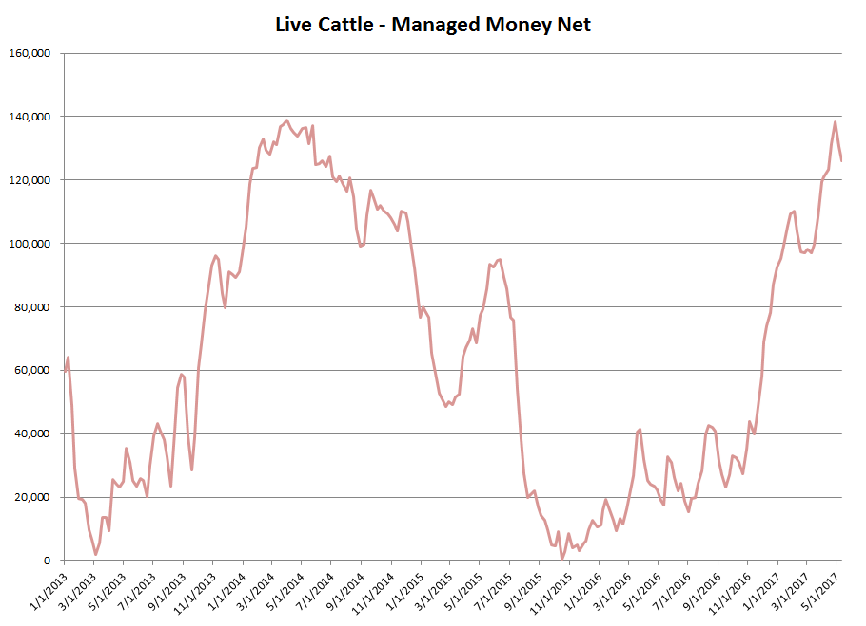

Friday’s COT showed a bit of liquidation in the managed money trade but nothing major. The MM position still seems “elevated” here and remains something we should be keeping our eyes on.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.