Livestock –

Livestock –

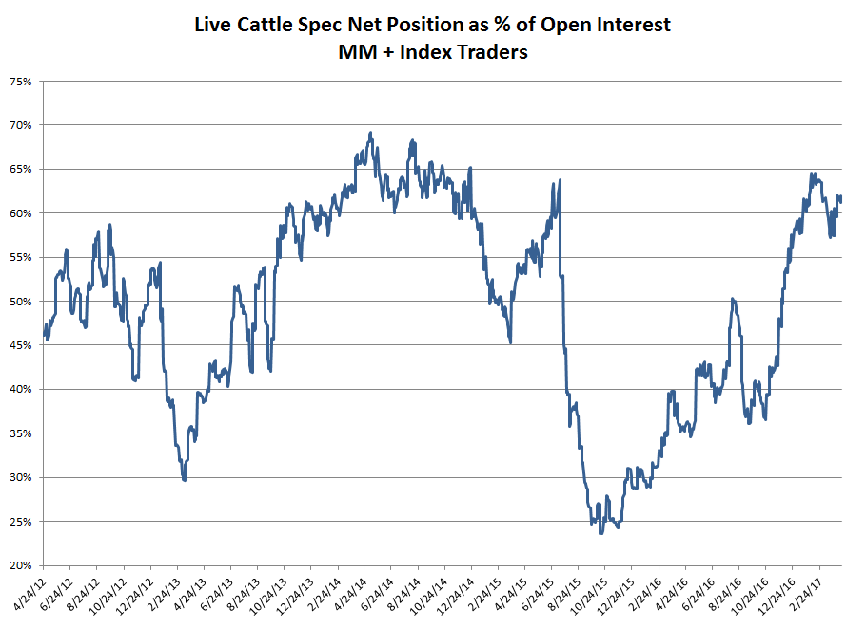

If it felt yesterday that I was picking on cattle hedgers for being short as the market went higher, I apologize. Today I want to present the spec positioning as shown on the latest COT report. The attached chart shows the percentage of open interest that MM and index traders comprise in cattle. As you can see, this is near its highest level since the previously mentioned 2014 futures rally. Intuitively, it makes complete sense that a large hedge position from the feeder would likely be offset to a large degree by a large spec long position. Still I think it is worth noting how big the position is. If I chose to produce a chart showing just the total MM and index trader net position, the total would be larger than what we saw in 2014 (larger aggregate open interest keeps the % lower).

So while in 2014 it was the feeder that ended up being squeezed (higher) it doesn’t necessarily have to end up that way this time. Placement data certainly indicates summer supplies will be increasing and it sounds like early estimates for March placement figures are impressive. So, to repeat, just because positioning is set up similarly to 2014, it doesn’t mean the market action will be the same.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.