Grains –

Grains –

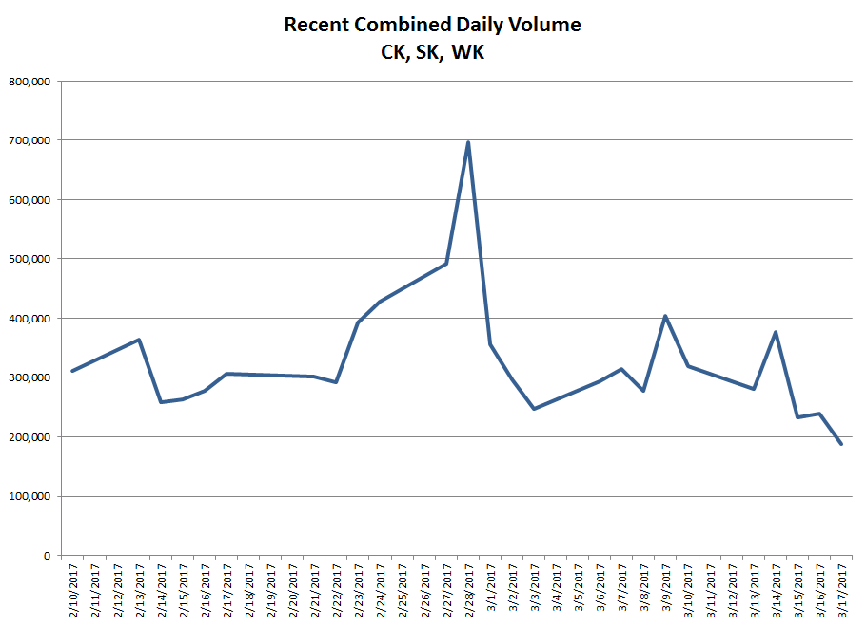

Note the chart attached here showing the combined daily volume in the major May contracts at CBOT over the past few weeks. As you can see, volume has been steadily declining and I would imagine that might continue to be the case until we get closer to the month-end reports. There isn’t really anything new to discuss right now. Export demand is seasonally declining, which should be reflected in inspections this morning. South American weather prospects continue to seem mostly favorable. US weather will be gaining more attention, but we’re still a ways off from widespread spring planting getting underway.

As noted above in the weather commentary, wheat will certainly pay attention to how this weather system develops later this week, which could bring the best shot of moisture for the region in quite some time. Deviation from the forecast for this event could certainly be one thing that could drive market action ahead of the month end reports, but there is little else to get excited about in the next two weeks. Markets should be on hold until 3/31.

As an example of markets’ overall indifference until 3/31, note Safras raised their Brazilian corn production estimate to 98 mmt on Friday…and the corn market didn’t even blink.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.