Grains –

Grains –

Last week’s NOPA crush report reported sharply higher soyoil stocks than the average guess expected, though we “knew” to take the over as we suspected soyoil use in biodiesel production would decrease in the new tax year. This was based on seasonal considerations as well as the expiration of the blending tax credit. Though that has once before been retroactively reinstated, optimism for another such reinstatement is not high under the new administration.

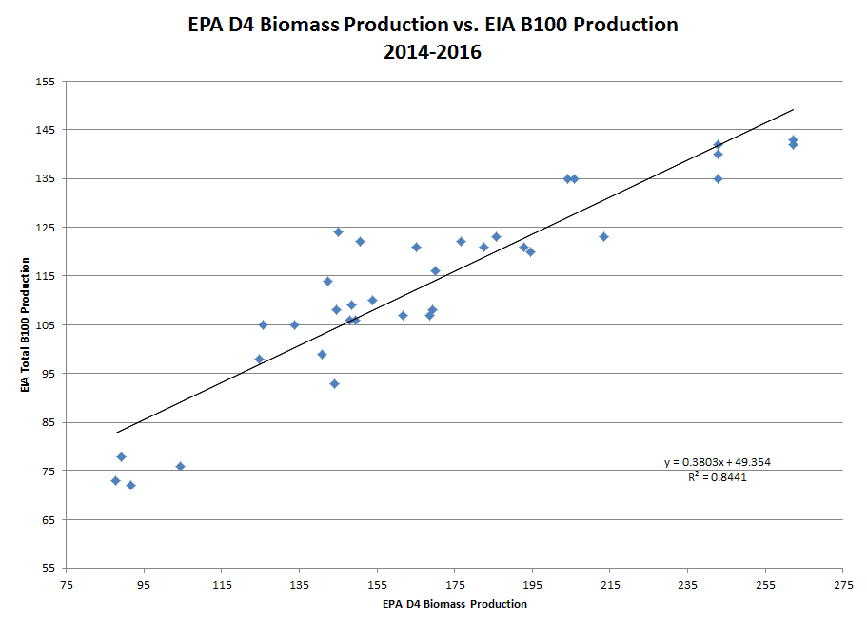

Then late last week EPA updated RIN generation figures and this gives us more confidence that biodiesel use is indeed slowing into the new calendar year. As you’ve heard me complain before, the EIA updates biodiesel production very slowly (the most recent data is as-of November) but the EPA is more timely with their RIN figures and we can use these to guesstimate biodiesel production.

The EPA is reporting RIN production in January of roughly 126 mil gal. While this is basically unchanged YOY it is down sharply from the pace seen during the past few months. December was especially active with 351 mil gals reported, most likely trying to take last minute advantage of the expiring tax credit.

As shown in the attached scatter, we can use the EPA’s RIN figures as a way to get a ballpark biodiesel production figure before the EIA gets around to eventually reporting it. In this case the scatter implies roughly 100 mil gall of B100 production in January down from roughly 185 mil gal in December. Assuming soyoil accounted for a little more than 50% of all inputs into biodiesel production in December and 49% in January, I am ballparking Dec soyoil use at roughly 685 mil lbs and Jan at 350 mil lbs.

I’ve plotted both of these figures into the attached seasonal look at soyoil use in biodiesel production. As noted above, it is very common to see a decline to start the New Year, but the pace required by the WASDE projection would certainly need to see a fairly quick upturn in the months ahead. Given uncertainty regarding RFS requirements for 2017 (new EPA Chair Pruitt was confirmed on Friday) I’m not especially optimistic this will be the case.

Strong palm oil markets and expectations for massive biodiesel use were the spark that kicked off the oilshare trade late last year (in addition to overall meal sluggishness). As noted above the biodiesel story has turned more complicated now and the chart of palm oil is not looking especially strong. With this in mind, its hard to have a lot of optimism towards oilshare right now, unless you’re just hoping on outright meal weakness.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.