Energies –

Energies –

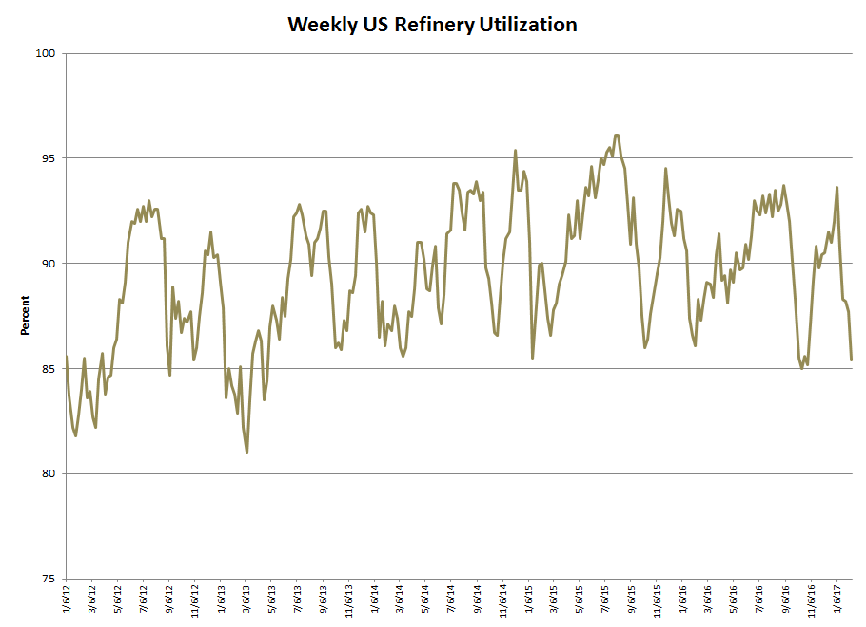

The crude oil inventory figure yesterday was once again deemed to be price-negative, yet once again futures mostly shrugged off this sentiment. I think we have to understand part of the “problem” leading to these surging inventory levels is a big downturn in refinery utilization, which is a very common occurrence at this time of year. Refinery runs typically start to pick back up in late Feb or early Mar.

It might also be worth pointing out that US crude oil exports averaged over 1 mbpd last week for the first time on record. The slowdown in refinery runs is aiding exporters’ ability to make shipments right now and it is worth noting that WTI prices are well under most other global benchmarks at the moment. Don’t be surprised if we see a strong export pace for another few weeks as refinery rates are slow. Additionally, the long term trend is most certainly higher for US crude oil exports going forward.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.