Crops –

Crops –

Markets sharply lower this morning largely due to a wet look to the QPF maps as shown above. It also helps that rainfall totals from the systems late last week didn’t “bust” like some earlier events have.

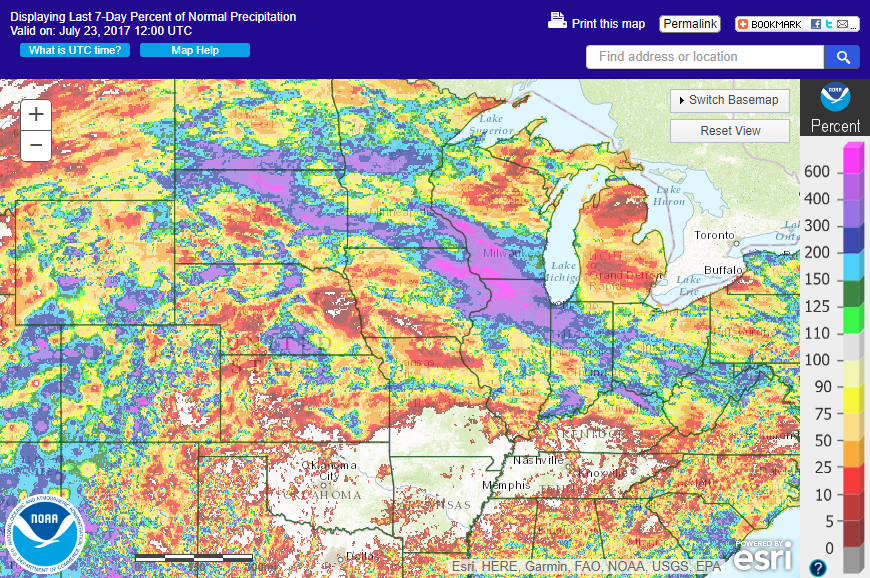

Still, as I look at the current weather/condition set-up, I can’t say that I’m feeling all warm-fuzzy about things right now. Here is a look at the percent of normal precipitation over the past 7 days.

Despite improved rainfall in IA, most of that state still saw below normal rainfall during this period. Rainfall in eastern NE and most of MO was a big disappointment as well. Rainfall in southern IL and southeastern SD was limited as well. Is northern IN and southern WI too wet? I’d say there are still a lot of question marks for the current set-up and I think the above map might imply that conditions on today’s Crop Progress report might still decline from last week. Keep in mind temps through western portions of the Corn Belt were pretty brutal last week as well. The departure from normal temperature is shown below.

Based on the above maps I wouldn’t be surprised to see condition ratings lower again today. This week’s rainfall projections, assuming they verify, will obviously be very helpful but we have to keep in mind the conditions we’ve seen up to this point in a large part of the WCB have been less than ideal. Is one week of good rain going to turn the tide for this crop? Keep in mind the 6-10 day period is expected to feature very limited rainfall chances as of now, though admittedly the cooler temps will help.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.