Energy –

Energy –

Crude oil futures are positing a modest bounce this morning following yesterday’s smackdown off the 50-day MA. This could be partly due to the above-mentioned saber-rattling, which is often times supportive for crude oil. Additionally, yesterday’s API inventory release showed a larger than expected drawdown in US oil inventories of 5.8 mil barrels. Today’s EIA release has been expected to show a decline of 2.0 mil.

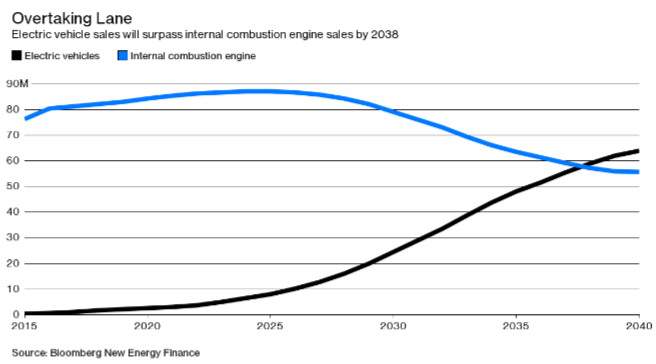

The report yesterday from Volvo that it is looking for every car it produces from 2019 on to have an electric motor as opposed to a combustion engine was pretty interesting to me. It really seems the conversion to electric vehicles is going to start happening very fast. It is estimated that electric car sales in the US account for only 1-3% of total sales right now, but obviously that number is only going to grow and it might grow fast. Bloomberg is running an article this morning suggesting that they believe electric cars will outsell gas/diesel cars within two decades. They say electric cars could account for a third of the global auto fleet by 2040…and they estimate this could displace about 8 mbpd of oil production. For reference the Saudis currently export roughly 7 mbpd. What I find interesting about these projections is that each new projection on electric vehicle adoption seems to be getting more and more aggressive. This tells me the pace is growing faster than expected and we should be prepared for what this means in terms of global energy consumption. It also means we won’t really be waiting for 2040 for a major shift in consumption trends to affect our markets.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material