Energy –

Energy –

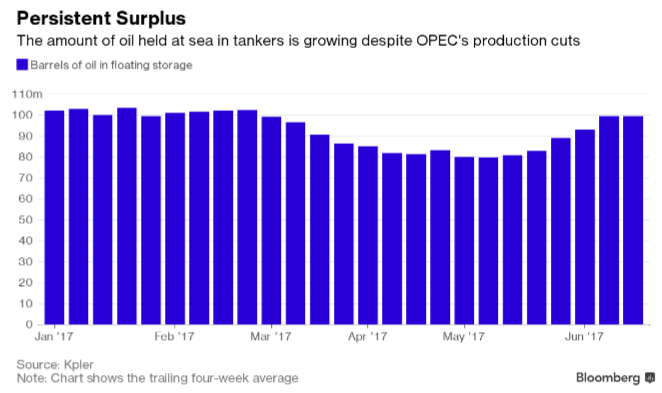

Crude oil prices are trading at 7-month lows this morning following data showing the amount of oil stored in tankers reached a new high of 111.9 million barrels earlier this month. Note the chart below is showing the 4-week average, which hasn’t yet made a new high. This clearly isn’t what OPEC was wanting to see with their production cuts.

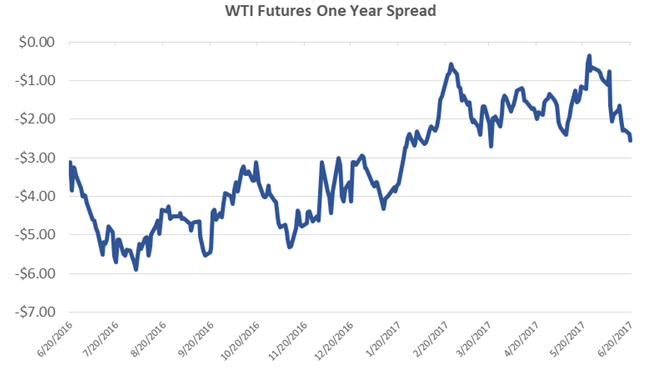

You can see the issue developing in the spreads recently. The chart below shows the one-year calendar spread in WTI futures. After taking a few attempts at inverting, the futures spread has fallen in recent weeks as it is becoming clearer the OPEC supply cuts are not yet having their desired results.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.