Livestock –

Livestock –

A lot of headlines this morning saying China will now allow US beef imports following a trade deal. I once again do want to point out that China reopened their market to US beef officially a few months ago, it’s just that neither side has agreed on protocols. I suppose this should finally get those protocols through all the proper channels. In exchange for increased beef (and natural gas) exports from the US, the US will allow imports of cooked chicken from China starting in July.

For the past few days I’ve made some statements suggesting beef prices could be in for a rough ride in the near future. Those statements are looking pretty stupid right now. The cutout continues to move higher, though it still appears volumes are declining.

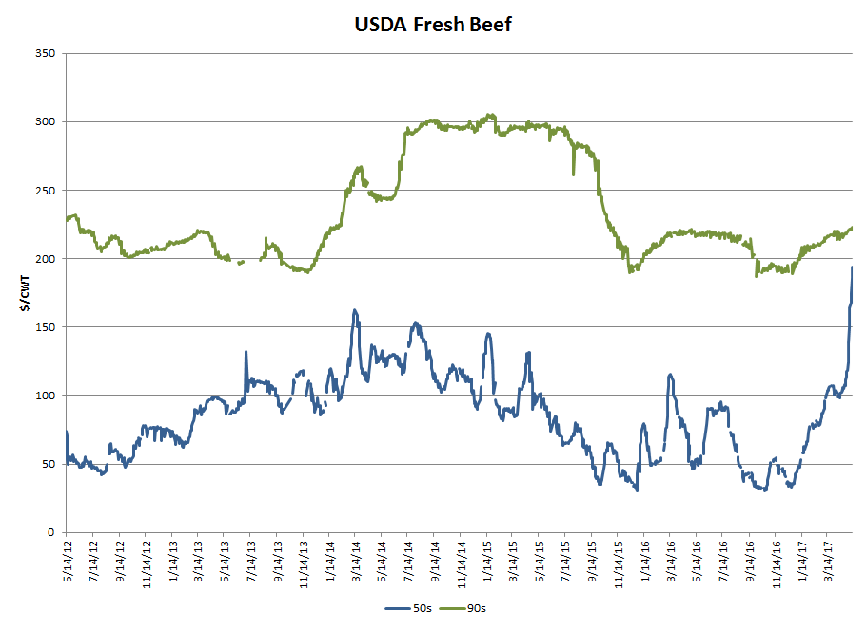

However it is worth noting that most of the fireworks in the beef market are coming in 50% lean, while other lean-basis products are acting a bit more rationally. To illustrate, I have a chart here showing the historical price action of 50s and 90s. As you can see, 90s have moved higher here recently but not in spectacular fashion. On the other hand, 50s have hit new record highs for several days now.

The problem with 50s could be that with the record basis and inverted board structure, we’re pulling cattle forward and these cattle might be a little more “green” (note carcass weights). This might potentially leave a bit less fat trim on each carcass, meaning 50s are in shorter supply than, for example, the 90s. It also probably doesn’t hurt that this is taking place right when we’re looking at a major grilling holiday weekend right around the corner.

I suspect the 50s market will calm down before too long and I’m still looking for beef prices in aggregate to stall out here in the near future. That isn’t exactly a bold call, however, as we typically see a seasonal peak in late May. Your guess is as good as mine as to what this will eventually mean for cash and the board.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.