Energies –

Energies –

I’ve noted for a while now that the market has pretty much baked in an extension of the OPEC production cuts beyond this month and I wondered aloud how OPEC was hoping to stir up added price gains considering this was priced in. This morning we see the next phase of this effort, with both Saudi and Russian officials saying the production cuts could be extended beyond this year. OPEC is now essentially trying to keep these production cuts “open-ended” in an effort to support prices, but as you can see from looking at the quotes this morning the market seems relatively unimpressed. For starters, there is the question of how effective this will be considering production is likely to increase in Nigeria and Libya from this point forward. Additionally, Iran would seem unlikely to be willing to continue with these restrictions as they continually cite goals to increase their production capacity. On top of that, Kazakhstan hasn’t even really put in much effort to stick to their production cut agreement and most expect production to expand there as well.

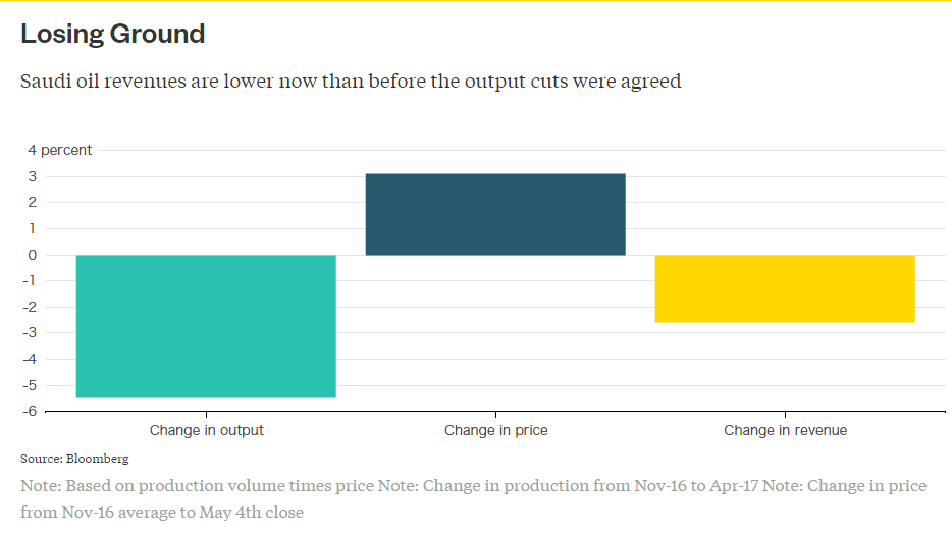

The financial state of the Saudi government is also in question. How much longer can the government continue to keep this up? Note the chart below (source:Bloomberg), showing that despite the gains in price since the production cut agreement went into effect, the Saudis are still seeing lower revenues due to lost market share. Mix in the fact that prices remain in a range that allows for expansion of US shale production, and this doesn’t seem like a winning scenario for the Saudis.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material