Livestock –

Livestock –

The NAFTA talk yesterday sure did a number on livestock markets. I’m not sure if anyone even paid attention to the FCE or other cash talk because the action was all driven by fears of NAFTA termination.

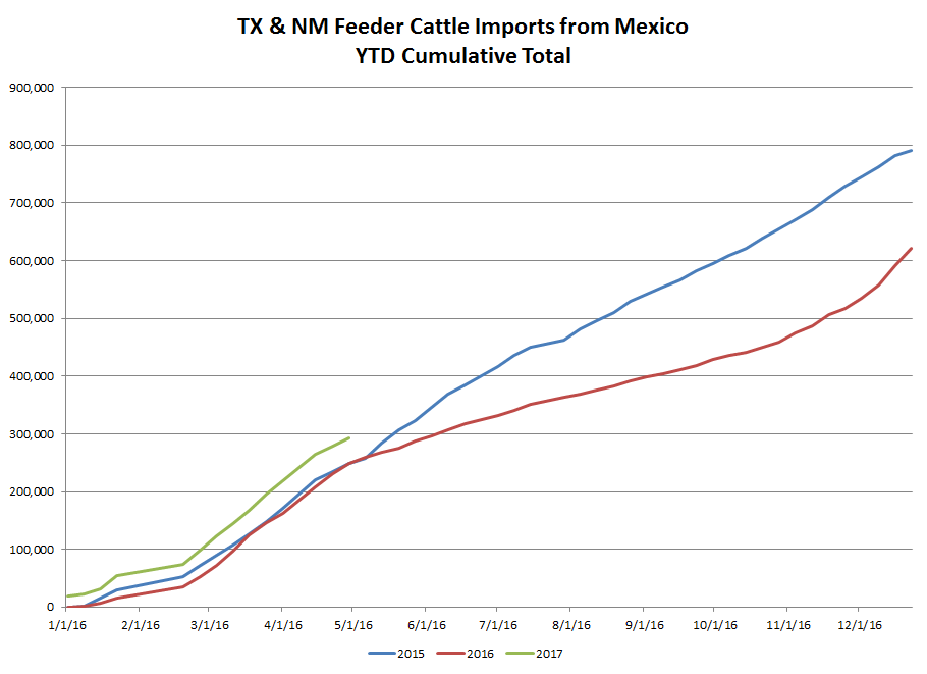

In cattle, this of course was a bullish feature due to the number of feeder imports we receive out of Mexico each year. Now admittedly, just because NAFTA might be scrapped doesn’t necessarily mean these imports will halt, but that is the fear at the moment. As you can see from the chart below, YTD feeder cattle imports are running ahead of the past few years. Any sort of disruption in this action would certainly create some havoc.

Of course the reverse action was seen in hog futures, as Mexico is the destination for US pork exports. Consider the following data:

So, any sort of retaliation by Mexican officials could also pressure US export demand. Mexico is also a decent sized importer of US chicken products, and this backing up in the domestic market will not bode well for wholesale/retail prices.

Keep in mind, however, Trump has backed off these claims for now. Even if Trump were to sign such an EO, he’d still have six months to change his mind through negotiations. It isn’t an automatic change. Still, we know the market will not take its time in assessing the situation for the worst.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.