Grains –

Grains –

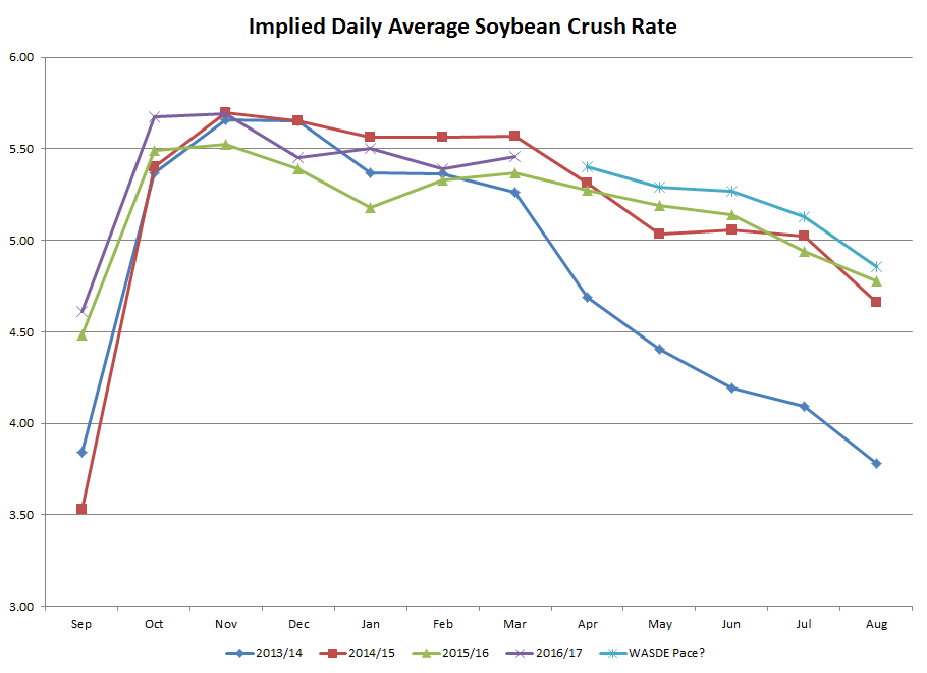

NOPA will release their monthly crush report today. The Bloomberg survey shows expectations for the crush to total 158.9 mil bu, which would be up slightly from last year’s 156.7 mil bu total. I won’t sit here and have any major argument against this guess. The implied daily average crush would be up from last month, but not by a wide margin. Hitting this mark would also keep the WASDE 1,940 mil bu annual crush figure within reach. Attached I have a chart showing recent average daily crush figures and the blue line shows what would need to be seen for the remainder of the year to reach the WASDE projection. Keep in mind I’m using the average guess for the March figure. While these averages would be the highest in several years, it seems reasonable to think these are achievable considering the commercial ownership of soybeans as illustrated in last month’s Quarterly Stocks report. It would probably take a pretty big miss (lower) vs. the average guess for WASDE to consider any downside changes next month.

I’ll also be watching the soyoil stocks figure and implications for implied disappearance. The average guess is for 1.812 bil lbs of stocks, and this is shown in the attached chart for the month of March. As you can see, this would be slightly under last year’s stocks. I’m going to take a low-confidence over vs. the average guess. Though it was probably largely overlooked in last month’s WASDE, they cut non-biodiesel domestic disappearance pretty sharply last month. As I’ve pointed out here more than once, I think there are some reasons to be not completely confident in the biodiesel demand figure as well, so this soyoil balance sheet will be something worth keeping an eye on over the coming months if biodiesel and stocks figures start to look a bit less promising.

Also on tap today we have weekly export inspections. I think this will continue to show that exports are progressing at a pace that exceeds the current WASDE projection. I’m still surprised they cut exports two months ago, and I think they’ll eventually need to go higher here. So with crush steady and exports smaller, it appears for now the old crop soybean carryout is done getting smaller. This might be one reason the N/X spread has been able to find some support recently. I understand many will still say this will move out to a carry overtime, but the likelihood of a smaller eventual carryout and a chart that has found some support might hold things together for a while.

Lastly today we have the weekly Crop Progress report. I’m seeing one guess at today’s corn planting progress of 8-9% complete compared to 3% last week and ~14% on average. This seems fairly reasonable to me. I’m still a bit concerned that the market is leaning a bit too short right now into key growing season, but that won’t matter til it matters. It is still very early…

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.