Financials –

Financials –

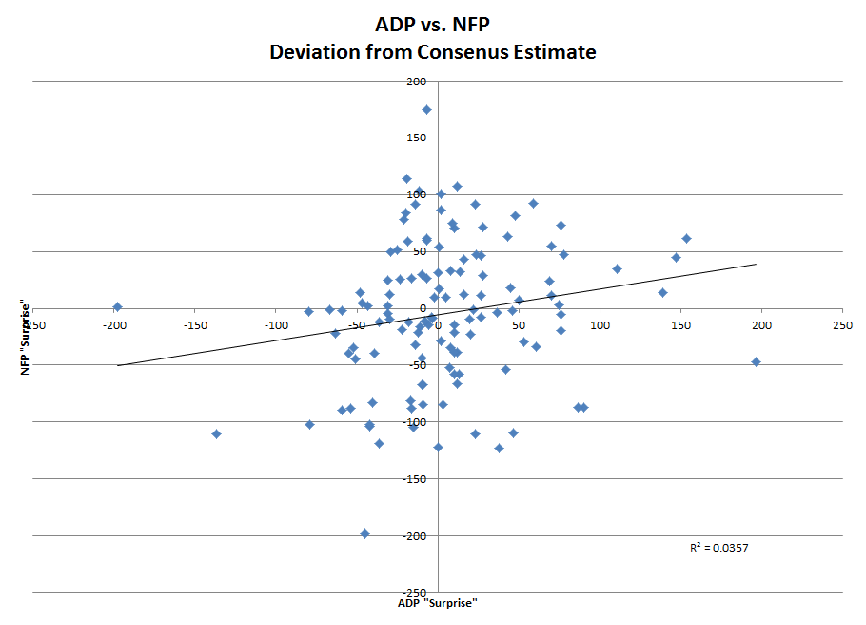

We have a very important NFP figure to digest this morning. Following the blow-out ADP report earlier this week, many are looking for a similar “beat” from the NFP today. The attached scatter chart, however, shows why that might not be the smartest bet. This shows the surprise (vs consensus estimate) on the ADP report vs. the NFP, and as you can see there isn’t really a strong correlation between the two. Admittedly, perhaps this is because the NFP gets revised a bit following the ADP report, but I still think it is an interesting thing to keep in mind.

In addition to the headline figure (expected +180k), I’ll be closely watching the wage growth figure. Considering the market’s adverse reaction to the FOMC minute’s focus on shrinking their balance sheet, even a beat on the headline figure might not be friendly if the wage growth figure shows increasing inflation pressures. Expectations are for YOY hourly earnings of +2.7%. If that beats, it might be interpreted as signs of increasing inflation which might prompt the Fed to either hike rates more quickly and/or work to reduce their balance sheet more quickly. Based on the reaction to the FOMC minutes earlier, I’m not sure that would be taken well by equities.

Of course the other thing to keep an eye on would be if we saw a considerable miss vs. the expectations. And by “expectations” I think we have to admit that following the ADP release the market is leaning towards something more than the +180k mentioned above. 10-year yields are still close to breaking out of their post-election trading range, and with the MM community still pretty heavily short that is one thing to keep a very close eye on this morning if the data proves to be a disappointment. Yields were flirting with this level overnight as well following the Syria reports, but have since backed off.

It is worth noting that Winter Storm Stella that hit the Northeast last month could potentially have a negative impact on the payroll figure. There is also a tendency for the March payroll figure to come in under the consensus forecast, but again the ADP figure would seem to argue against that this time.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.