Grains –

Grains –

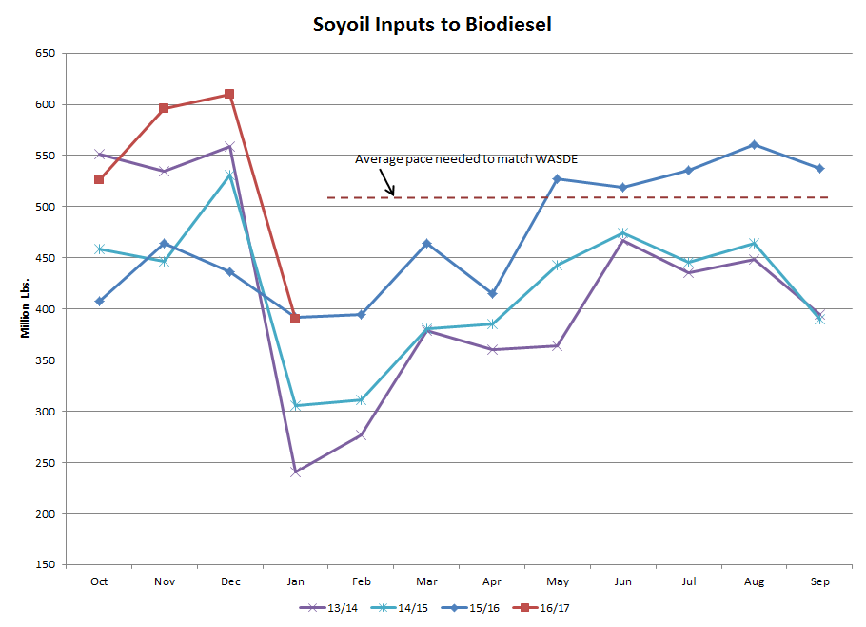

Overlooked by all the NASS data released on Monday, the EIA updated biodiesel production for January. As expected, biodiesel production dropped sharply in January following the expiration of the blending tax credit at CY 2016 end. Total soyoil inputs for biodiesel production were 390 mil lbs, which is actually slightly lower than last year’s production rate, marking the first YOY decline in monthly use since December 2015.

Attached here is a chart showing recent soyoil use in biodiesel production. Based on the EPA’s RIN data, we should probably expect Feb soyoil use to increase slightly from this Jan level, but not much. That will push that average pace needed for the remainder of the marketing year even higher. Certainly such a pace is attainable, but at the same time I do think this is solid reason for doubts. For one thing, we have the end of the blending tax credit which of course was largely behind the surge seen at the end of 2016. Additionally, we have a new EPA administration and this group is more likely to interpret the RFS rules as they were intended. This means they could allow for rollover RINs to be applied to the mandate for CY 2017. If you recall, the Obama EPA would retroactively increase each year’s mandate to offset the entire “book” of RINs generated. Though I don’t know for certain, I somewhat doubt this new EPA will use the same tactics. I don’t expect WASDE to make any changes in their projection right now, but I do think this is something we’re going to need to come back to in a few months.

The only other item of note in the EIA report is the sharp drop in biodiesel imports. Again, this should come as no surprise given the expiration of the tax credit but it just further underscores what a factor that tax credit had become in production/blending rates. It’ll be interesting to see how imports develop going forward. Some have argued that the expiration of the tax credit will essentially halt imports. I agree that the expiration of the credit lessens the demand for imports and domestic production alike, but from an economic standpoint imports are no less competitive without the tax credit than before.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.