Grains –

Grains –

On tap today we of course have the weekly COT report. Keep one thing in mind, however, that the major March option expiration will likely make this week’s data look a bit more volatile than usual. Those groups that produce guesses on this sort of thing should probably take the week off. Then again, I’m not sure why anyone bothers to try and guess these COT positions… but that is a discussion we can have over drinks.

Arguably the key focus in ag markets so far in 2017 has been fund flows. I’d argue that this has been a much bigger influence on price action than weather and export demand. With that in mind and in preparation for today’s COT report, let’s look at some few charts on the spec positioning.

The first chart is nothing special, it simply totals the managed money net position in the key ag futures markets we track here. As you can see from the chart, the net position has grown sharply since the start of the year and one could argue it is looking a bit stretched at the moment, especially with no immediate weather threats to be found.

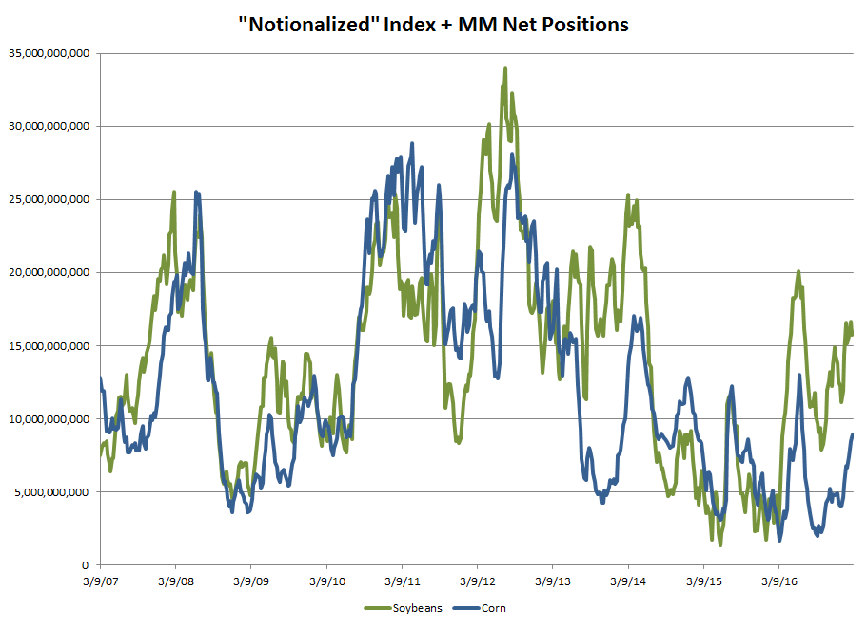

That said, we have to understand that not all players look at this in terms of number of contracts but rather the total notional exposure of the position. With that in mind, please see the next chart which attempts to look at the combined index and managed money net positions in corn and soybeans in notional terms. This is simply taking the number of contracts times the actual value of the contract. This chart shows that in the grand scheme of things, the total fund value of the their positions here are not especially stretched yet. However, considering the stretched nature of the first chart one would have to think that it will take some sort of fundamental upside catalyst to push these notional values sharply higher from here. With South American weather and conditions seemingly on cruise control for now, it’ll likely take some sort of US spring/summer issue to develop. Will these new longs remain that patient?

The bottom line is that at some point it will take more than just “fund buying” to keep pushing prices higher. I’m not saying I believe we’re at that point right now…I honestly don’t know. What I am saying is that as I look around the fundamental backdrop I don’t see any near term catalyst for the fundamental support right now. If you’re buying CZ at $4, you’re essentially betting on a US weather problem that is months away from materializing.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.