Grains –

Grains –

It seems every other newswire article I see these days discusses the Brazilian road problems on the way to ports in the north. There seems to be some consensus thought process that this is a YUGE problem and the US could potentially see an increase in export business due to these logistical snafus. Well, for starters we need to acknowledge that just because Brazil is harvesting their crop is doesn’t mean US sales just stop. Of course we’re going to be picking up cargoes of sales here and there. Still, the market is concerned, so let’s look at the math.

The most recent article I’ve seen notes “about 1,500 trucks loaded with soybeans, of a total of 2,500 trucks, are halted” along the route. On second thought, however, these numbers don’t sound exclamatory enough so I’m just going to make up something…we’ll say 5,000 trucks of soybeans are halted on the route. Depending on who you ask, each truck probably holds 40-50 mt of soybeans, but again let’s just say 55 mt to be aggressive. Here is the math… 5,000 trucks x 55 mt = 275,000 mt. Again depending on how you want to work your math, that’s roughly 5 cargoes.

Does the market really want to throw a fit over 5 cargoes? Apparently it does. I’m not saying these articles are responsible for the strong price action (you can mostly thank Fund Bro for that) but they surely don’t hurt. Still, we’ll get official Feb export data probably today and it is likely to show ~6 mmt of soybean exports which would be a new record for the month. That would imply to me that the new crop export program is running smoothly overall, unless of course you’re the poor sap paying demurrage on a theoretical 5 cargoes in the north because you were counting on a bunch of trucks full of soybeans traveling through the rainforest on dirt roads.

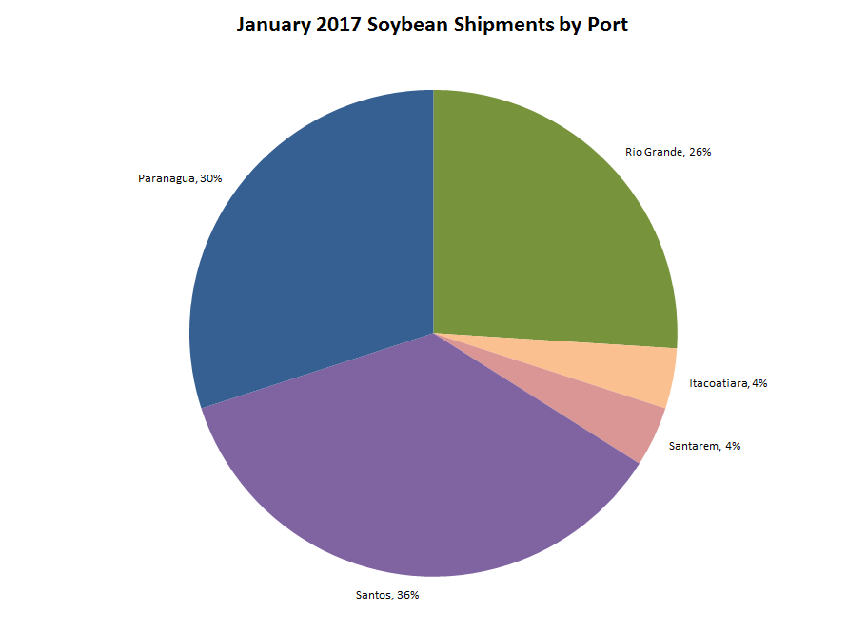

The chart below shows a breakdown of soybean shipments by port in January of this year. The two northern ports represented here are Itacoatiara and Santarem. These comprise roughly 8% of Brazil’s total soybean shipments. Again, I’m not sure why this is such a popular story considering the south is running smoothly.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.