Livestock –

Livestock –

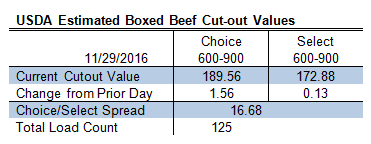

Cash cattle trade remains slow this week. There was some very light trade of 84 heifers in NE at $170, near the low end of last week’s trade range. Most action is probably waiting until today’s Fed Cattle Exchange is done. Cutout held together pretty well, and over the last 30 days is actually up a decent amount with Choice up $3.88 and Select up $4.15. Over that same time (since the week ended 10/28) cash prices paid by packers increased about $7 for live cattle and $10-11 for dressed cattle. You can see that the rise in cash has outpaced the increase in boxed beef.

South Korea will cull 3% of its total poultry population to curb an outbreak of bird flu that has hit a number of farms across the nation, its agriculture ministry said on Tuesday. This should be around about 2.78 mil birds taken out of the system.

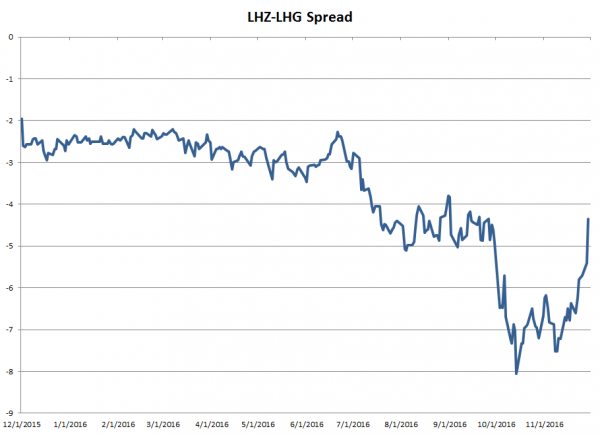

Hog carcass weights for the week ending Nov. 12 averaged 212 pounds, 1 lb heavier wow but 2 lbs below last year’s weight. The pork cutout was down nearly $1 thanks to sharp losses in the ham, belly and butt. Futures were mixed with spot LHZ slightly down while LHG suffered its second day of triple digit losses. The spread between Z/G has been narrowing for about a week. LHZ only has a few more weeks of trading and remains a few dollars over the index, LHG which will take over is about $8 over the index

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.